Page Contents

ToggleWhat is KYC, and why is it required on MPL?

KYC, short for Know Your Customer, is a method used to verify your identity using a government-issued ID, such as an Aadhaar or PAN card. The MPL KYC process is essential to ensure you are genuine and of legal age, and it also protects against fraud.

But why is KYC required on MPL? Can you do without it? The MPL KYC process is a must for regulatory compliance and to ensure that withdrawals are securely processed into your account via bank transfer or any other preferred method. This is a crucial step once the prize money is credited to your MPL wallet. It keeps your money safe and prevents identity theft. MPL also utilizes secure systems, such as OCR, facial recognition, and liveness checks, to protect your data and privacy in accordance with applicable laws.

So, if you are wondering, ‘Is KYC safe on MPL?’ The answer is yes. Here’s the MPL KYC guide to answer all your queries about the KYC verification process on the app.

How to submit your KYC details on MPL

KYC is important for withdrawing your winnings from the MPL wallet to your bank account or through other preferred methods, such as Amazon Pay or Paytm wallet. How to perform KYC on MPL? Take a look at the MPL KYC submission steps in our MPL KYC guide.

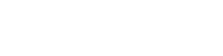

Step 1: Open the MPL app

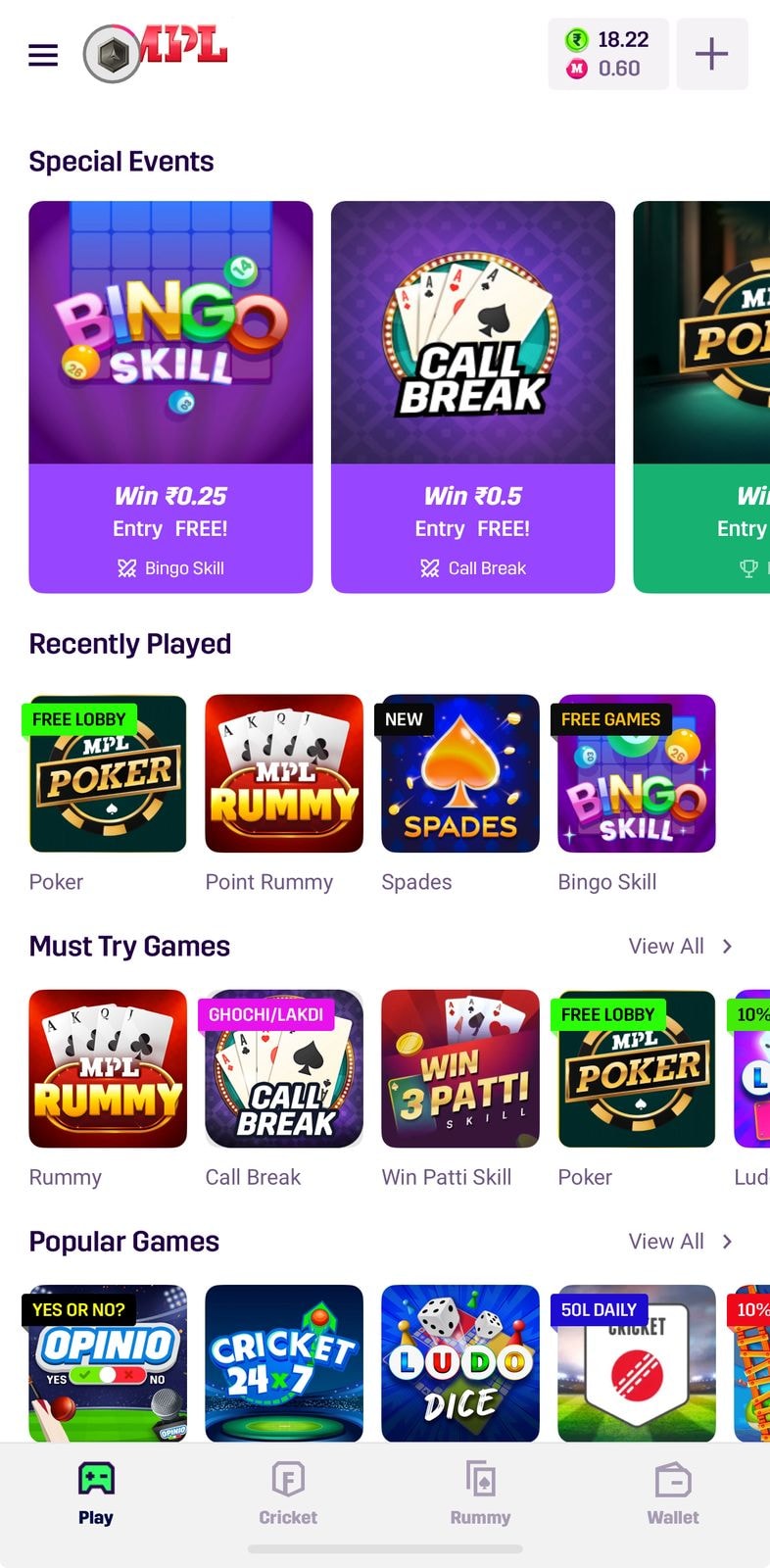

The first step in our MPL KYC guide is to open the MPL app and tap on the “Wallet” option at the bottom right of the screen. Scroll down until you find the “KYC Verification” option.

Step 2: Tap ‘KYC Verification’

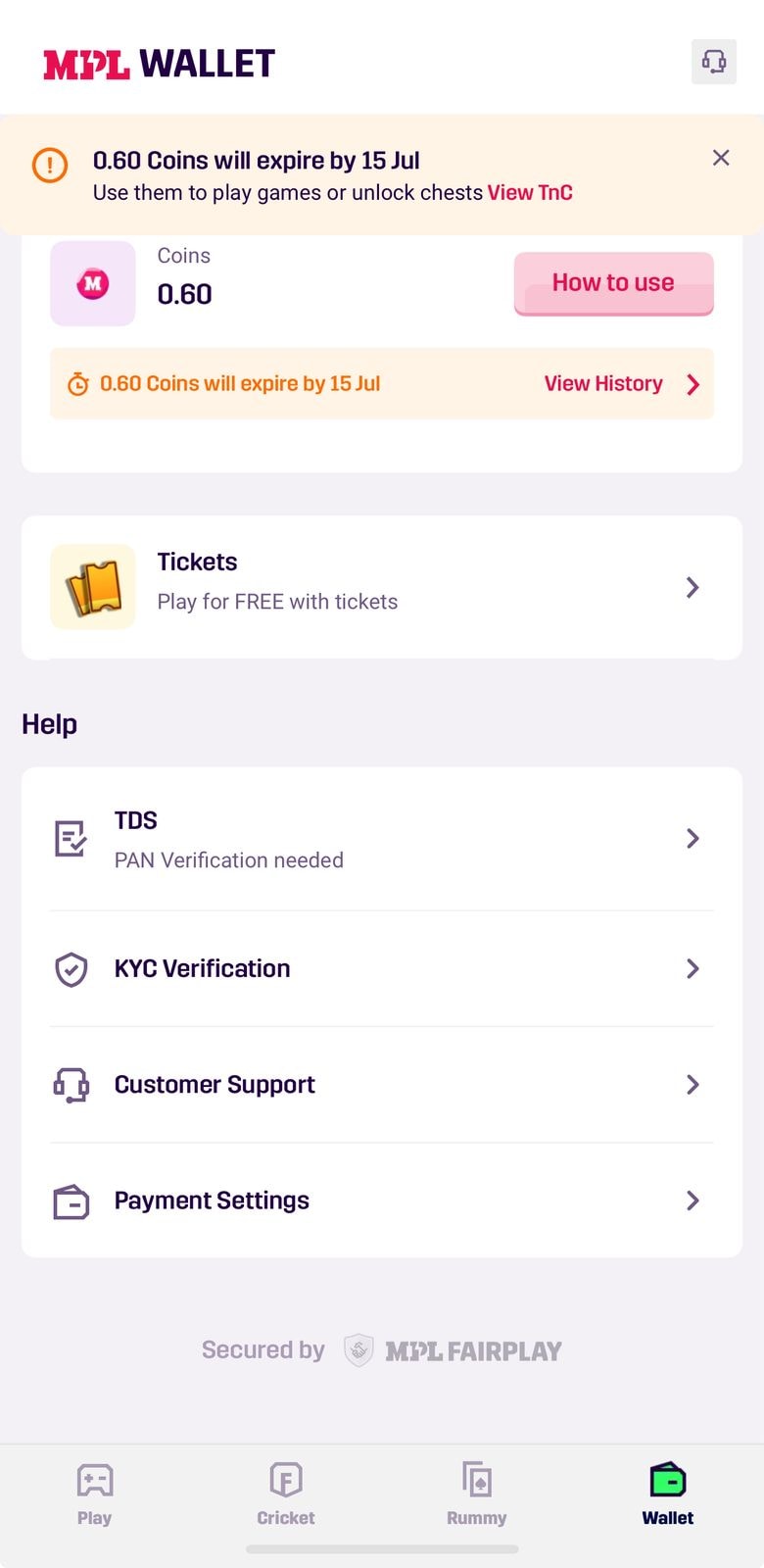

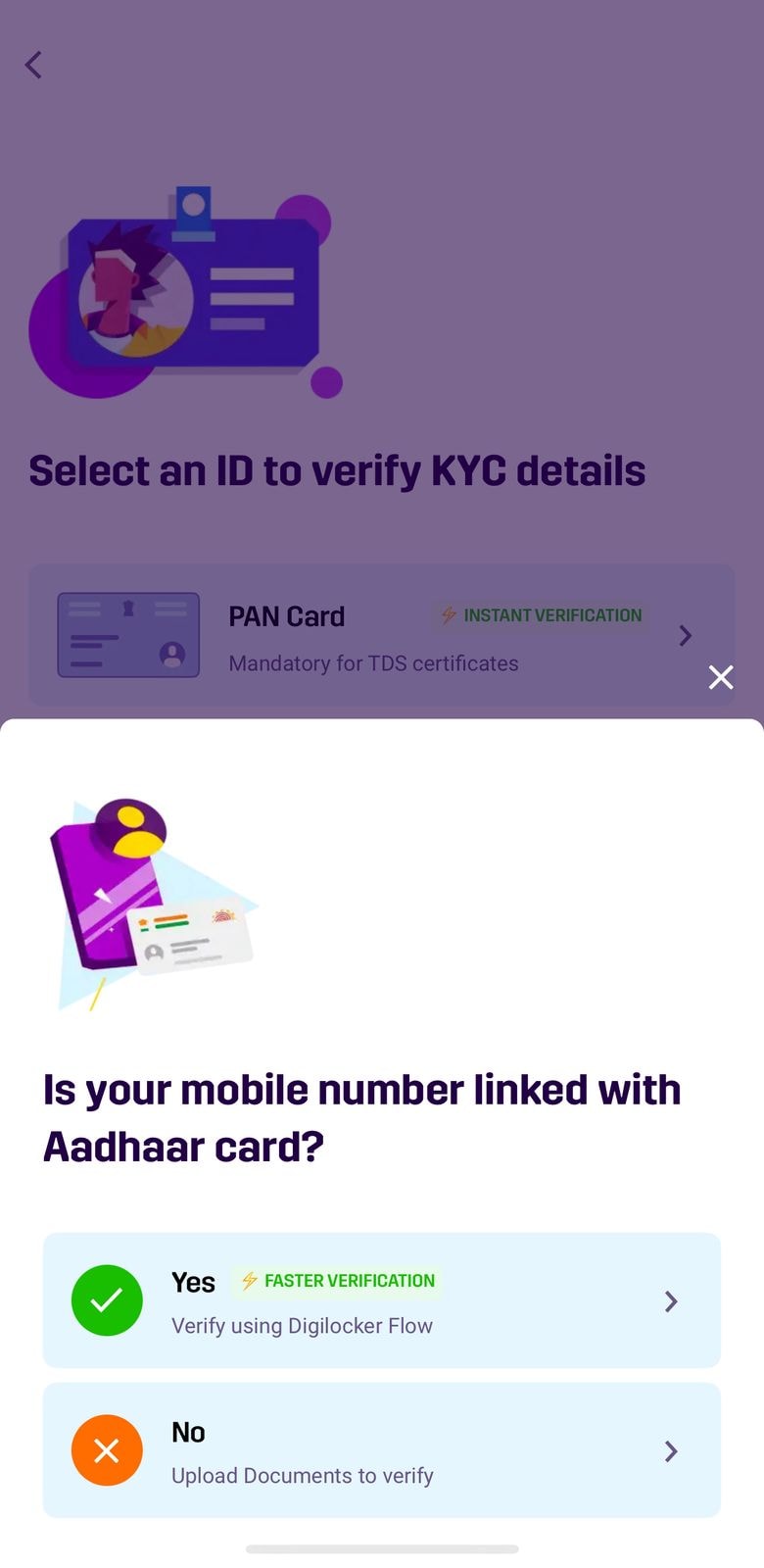

Once you tap on the KYC Verification button, you will see two options to complete your KYC: one using your PAN card and the other using your Aadhaar card. Complete verification on MPL as per your preferred method.

Step 3: Enter your PAN or Aadhaar details

Choose your preferred method and enter your PAN or Aadhaar details correctly. Make sure the name matches exactly on your documents.

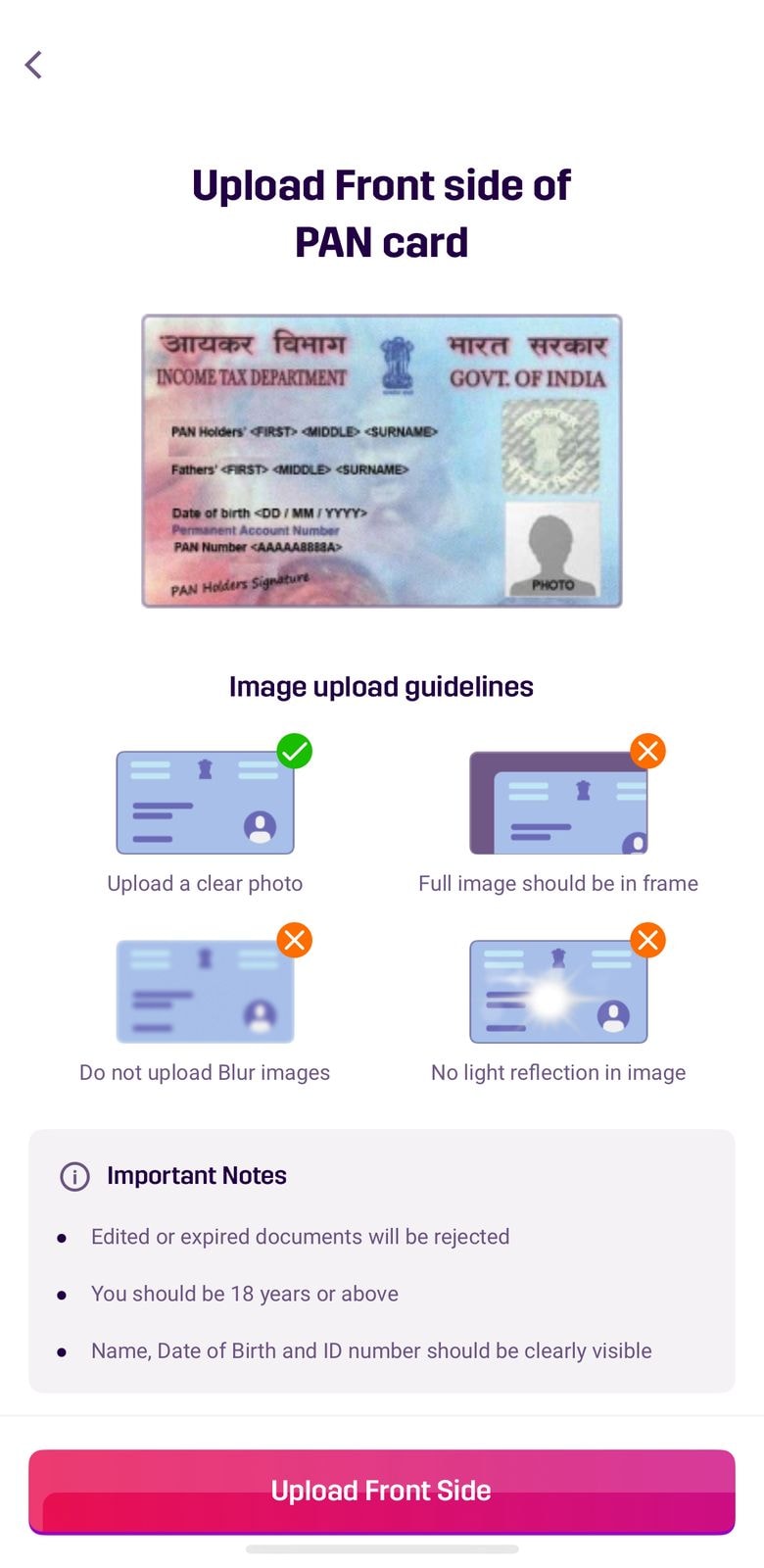

Step 4: Upload clear, valid documents & submit

How to submit KYC documents on MPL? To proceed, upload your PAN Card if you opt for the MPL KYC verification process using your PAN.

To verify using your Aadhaar card, you can proceed through Digilocker with your mobile number linked to your Aadhaar card or upload documents manually. Once you are done, submit your documents. The app will show a “verification in progress” message. KYC usually takes 24–48 hours to complete, after which you can withdraw money from the MPL platform.

How to update your KYC information

Even after you complete the MPL KYC verification process as per our MPL KYC guide, you will have to update your KYC as per financial regulations if there are changes in your details. Take a look at how and when to update your KYC information on MPL.

When to Update: You must update your KYC if your name, address, or ID documents (PAN, Aadhaar) change. This keeps your account compliant, allowing seamless use and withdrawals.

How to Update KYC on MPL: Go to Wallet and choose KYC Verification. Here, select PAN/Aadhaar update, upload your updated document, and submit. The system re-verifies your info, usually within 24–48 hours.

Required Documents for Updates: For PAN or Aadhaar updates, please upload clear, valid government-issued documents and either the original or a scanned selfie as required. Ensure details match exactly as per legal documents.

Fixing common KYC verification issues

Was your KYC rejected on MPL or is there an error? Here’s how to fix common MPL KYC problems.

- Error 1: Invalid PAN or Aadhaar: If the Aadhaar or PAN ID number you entered doesn’t match the actual card, your KYC gets rejected. Therefore, double-check your card info before submitting. If you have recently changed your PAN or Aadhaar, update those documents first, then re-upload them. This way, you prevent KYC errors.

- Error 2: Blurry or Incorrect Document Upload: Uploading unclear, cropped, or low-quality images can result in a KYC error on MPL. Use good lighting, hold your phone steady, and ensure the entire card, including both the front and back, is visible. Cropped or fuzzy images will be rejected. So, please upload clear, high-quality images.

- Error 3: Mismatch in details: If your name, date of birth, or other details on the document don’t match what you entered, your KYC will fail. Ensure that the names on MPL match those on the PAN, Aadhaar, and bank records. Even small differences, such as initials, can lead to rejection.

- Error 4: KYC stuck in “pending”: Sometimes the status stays “pending” due to delays. Wait 24–48 hours, as the MPL verification team typically approves within this timeframe. If it’s still stuck, contact MPL support with a screenshot. It will be manually reviewed and resolved. If the MPL KYC is not working, the solution is to contact the MPL helpdesk.

Quick Fixes:

Here are a few quick fixes to complete verification on the MPL app.

How to re-upload documents

Go to the Wallet section in the MPL app and tap on KYC Verification. If your KYC status shows “Rejected” or “Error,” tap Re-submit. Select either PAN or Aadhaar, upload a clear, well-lit image of the document, and then tap Submit. MPL usually verifies the details within 24–48 hours.

Customer support for help

If re-uploading doesn’t resolve the issue or KYC is stuck, tap “Help” in Wallet, select “KYC issue,” and submit your query along with screenshots. You can also connect with customer support for help if you’re facing verification issues. For any concerns or delays, simply reach out through the app or website. They will guide you step-by-step to troubleshoot KYC on the MPL app. You can even email [email protected] or connect with an MPL executive via In-App chat to troubleshoot KYC on the MPL app.

Tips for smooth KYC verification

Here’s how you can streamline the MPL KYC verification process.

Use official government-issued documents only

How to do KYC on MPL to ensure it doesn’t get rejected? Always upload valid documents, such as your PAN or Aadhaar. Other documents won’t be accepted during the MPL KYC verification process.

Upload in good lighting with no blurs

Ensure documents are visible, well-lit, and not blurry or cropped to avoid rejection or delay in verification.

Make sure names match across all IDs

Your name and details must match exactly across PAN, Aadhaar card, and bank account for smooth and successful KYC approval.

FAQs

Is KYC mandatory to play games on MPL?

KYC is not mandatory to play games on MPL. However, if you are playing for cash, KYC is important to withdraw your winnings. For instance, if you join a tournament with an entry fee and beat other players to win real money, the amount gets deposited in your wallet. To withdraw it to your bank account or any other preferred method, KYC is mandatory. So, while KYC may not be essential to play games, it is required to withdraw your winnings. Take a look at our MPL KYC guide in the above blog.

Can I withdraw money without KYC?

No, KYC is mandatory as per financial regulations. You cannot withdraw money from your MPL wallet to your bank account without KYC. If a third-party website claims to help you withdraw without KYC on MPL, be cautious of potential fraud. The entire KYC process is completed within the app, and you don’t need any coupon code or anything similar to complete it.

How long does it take for KYC to be approved?

MPL KYC verification process usually takes 24 to 48 hours after document submission, provided the details are clear, valid, and match your profile. You can check the KYC Verification section for an update.

Is my KYC data safe on MPL?

Yes, KYC data is safe on MPL. The platform utilizes secure encryption and adheres to strict data privacy policies. Your KYC details are stored securely and used solely for identity verification and compliance with legal requirements.

Can I change my KYC details after submission?

Yes, you can update your KYC details if needed. Go to the KYC section on the app and resubmit the updated documents for review and verification.