Page Contents

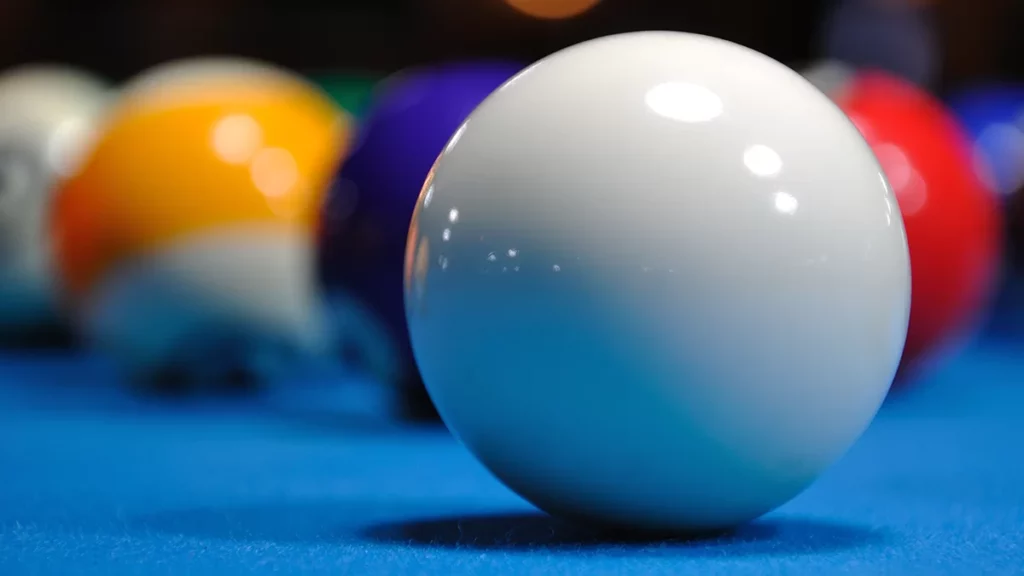

ToggleIf you’ve been winning real money on MPL, you might be wondering how the new TDS (Tax Deducted at Source) rules affect your withdrawals. Starting April 1, 2023, a new government policy changed how your game winnings are taxed. Here’s a simple breakdown of what changed and how it affects your earnings on MPL.

As per the government of India, the new TDS policy rules will apply from April 1, 2023, to the online game winnings of all users. The old TDS policy before March 31, 2023, imposed TDS on the winnings from online games exceeding ₹10,000. However, after the introduction of the new rules, online gaming platforms will levy a 30% TDS on the net winnings of users upon withdrawal.

If you play real money games online, here’s everything you need to know about the new TDS policy.

What is TDS?

TDS implies Tax Deducted at Source. According to the latest government policies, the online game winnings of users playing real money games on an online gaming platform will be subject to tax deductions. The TDS will be deducted only from the Net Winnings of the users.

Old TDS Policy vs New TDS Policy Rules

Old TDS Policy

According to the old TDS Policy before 31 March 2023, any winnings above ₹9999 were liable to TDS deductions. There was no TDS imposed on withdrawals below ₹10,000. For instance, if a user wins ₹12,000 (which is above the ₹10,000 threshold) in an online game, there will be a TDS of ₹3,600 (30% on 12,000), and the user will receive ₹8,400 upon withdrawal.

New TDS Policy

According to the new TDS Policy, all net winnings are liable to TDS deductions of 30% at the time of withdrawals w.e.f April 1, 2023. Net winnings exclude all the deposit amounts, opening balances, and withdrawals on which TDS is already paid from your total Withdrawals for the entire financial year.

Important TDS Terms

– Deposits: Total amount deposited by a user in their game wallet during a financial year (FY).

– Withdrawals: Total amount submitted as a withdrawal request by a user during a financial year (FY).

– Net winnings: [Total withdrawals in FY – (Total deposits in FY + Net winnings which are liable for TDS deduction during the FY + Opening balances )]

Calculation of Net Winnings and TDS

Based on the above formula of net winnings, we can calculate the amount of TDS that will be deducted. Let’s take an example:

Deposits in the FY: ₹1000

Total winnings: ₹2000

Net winnings: Total Winnings – Total Deposits = (2000-1000) = ₹1000

TDS applicable on net winnings post-withdrawal: 30% of ₹1000= ₹300

Net receivable amount on withdrawal: 1000-300 = ₹700

Looking at other instances,

| TotalDeposits | Withdrawals | Total Withdrawals in FY | Total Deposits in FY | Net Winnings on which TDS is Paid | Taxable Net Winnings | TDS | Net Withdrawals in Bank Account | |

| Apr 17 | 100,000 | 150,000 | 150,000 | 100,000 | 0 | 50,000 | 15,000 | 135,000 |

Suppose, on April 17, a user deposits ₹100,000 and withdraws 150,000 after winning some amount.

The total withdrawal for the financial year is 100,000

The net winnings, in this case, is 150,000 – 100,000 = 50,000

TDS on the net winnings = 50,000 x 30% = 15,000

Net Withdrawals = 150,000 – 15,000 = 135,000

| Total Deposits | Withdrawals | Total Withdrawals in FY | Total Deposits in FY | Net Winnings on which TDS is Paid | Taxable Net Winnings | TDS | Net Withdrawals in Bank Account | |

| Apr 17 | 100,000 | 150,000 | 150,000 | 100,000 | 0 | 50,000 | 15,000 | 135,000 |

| Apr 18 | 100,000 | 50,000 | 200,000 | 200,000 | 50,000 | -50,000 | 0 | 50,000 |

| Total | 200,000 | 200,000 | 200,000 | 200,000 | 50,000 | 50,000 | 15,000 | 185,000 |

Now, on April 18, the user deposits another 100,000 and withdraws 50,000

The total withdrawals will be = 150,000 + 50,000 = 200,000

The total deposits to date are 100,000 + 100,000 = 200,000

Net winnings on which TDS is already paid = 50,000

Therefore, Taxable Net winnings = Total Withdrawals – Total Deposits – Net Winnings on which TDS is Paid = 200,000 – 200,000 – 50,000 = -50,000

So, TDS on net winnings will be zero.

TDS Policy on MPL

MPL follows the new government policy and deducts 30% TDS only on your net winnings at the time of withdrawal. Don’t worry! MPL provides a TDS certificate every quarter and updates your Form 26AS if you’ve submitted your PAN. This helps you file your Income Tax Returns (ITR) and claim refunds if needed.

If you have submitted your PAN number and PAN Card to MPL, the TDS amount will be reflected on your Form 26AS, which will be updated at the end of every quarter. MPL will provide TDS certificates to you at the end of every Quarter, provided that you have shared your PAN Card with MPL.

FAQs

How much tax will be deducted as per the new TDS Policy?

According to the new TDS Policy, a 30% tax on the net winnings from an online real-money game will be deducted upon withdrawal.

When is TDS Deducted?

TDS on all net winnings will be deducted only at the time of withdrawal.

Will every withdrawal of mine be subject to a TDS of 30%?

No, at every withdrawal, your net winnings are calculated, and TDS is charged only on profit amounts.

Is MPL charging this TDS?

No. This is a government-mandated tax. MPL only deducts it and passes it on to the Income Tax Department.

How can I reduce my tax liability?

Avoid doing multiple transactions/withdrawals. Instead, try to accumulate the winnings and withdraw once a month.

My TDS has been deducted, will I get any TDS certificate for the same?

MPL will provide a TDS certificate every quarter in a financial year.

Can I get my TDS back?

A: If your net winnings at year-end are lower than the taxed amount, you can claim a refund while filing your ITR.

What if I end up paying extra TDS?

This can happen if a withdrawal is made when net winnings are positive and at the year-end, the user is in net losses. At the end of the financial year, 00:00 hours on 31st March, your final TDS will be calculated based on the net winnings for the financial year. Since the winnings earned from Online Gaming are liable for 30% TDS, users need to file their ITR, and the total TDS deducted can be adjusted against the Winnings liable for tax. If any excess TDS is deducted, it can be claimed back while filing the ITR.For more questions on the TDS Policy, read the FAQs on TDS.